In today’s fast-paced world, managing finances has become easier with the help of online platforms. One such platform is Skop Login, which provides easy access to commercial vehicle loans. For business owners and operators who rely on vehicles for transportation, logistics, or service delivery, securing a loan for a commercial vehicle is often essential. Skop Login has simplified the process of managing these loans with a user-friendly login system, making it easier for users to access their accounts at any time.

Understanding Skop?

Skop is a financial platform that offers commercial vehicle loans, enabling businesses to purchase or lease vehicles for business operations. Skop simplifies the loan process by offering competitive interest rates, flexible repayment terms, and a streamlined application process. With Skop, businesses no longer have to face the hassle of traditional loan procedures, which can be time-consuming and often require a lot of paperwork.

The primary goal of Skop is to make the process of acquiring a commercial vehicle loan simple, quick, and hassle-free. By providing access to an online portal, Skop allows users to manage their loan accounts, track their payments, and access important documents all from the comfort of their homes or offices.

Features of Skop Login

Skop Login offers a variety of features that help users manage their commercial vehicle loans effectively. Whether you’re a business owner, fleet manager, or individual seeking a loan for a commercial vehicle, these features can simplify the loan management process. Here are some of the key features:

1. Easy Account Access

Skop Login allows users to easily access their loan account from anywhere at any time. All you need is a device with an internet connection, and you can log in to your account to view important details about your loan.

2. Loan Details and Statements

Once logged in, you can access detailed information about your commercial vehicle loan, including the loan amount, interest rate, repayment schedule, and outstanding balance. You can also view your loan statements, which help you track your progress toward paying off the loan.

3. Payment Management

One of the most important features of Skop Login is the ability to manage your payments. Through your login account, you can make payments, schedule future payments, and view past payment histories. The platform often supports multiple payment methods, making it easy for you to choose the option that works best for you.

4. Loan Application and Pre-Approval

Skop makes it easy to apply for a new commercial vehicle loan. Through the login portal, you can complete the loan application, submit necessary documents, and receive instant pre-approval. This feature saves you time by removing the need to visit a physical office or wait for long periods to get an update on your loan status.

5. Customer Support

Skop offers dedicated customer support services through the login portal. If you encounter any issues while using the platform or have questions about your loan, you can easily get in touch with a customer support representative via chat or email.

6. Notifications and Updates

Skop Login provides notifications regarding upcoming payments, due dates, interest rate changes, and other important updates related to your loan. These reminders help you stay on top of your loan obligations and avoid late fees.

7. Secure Access

Skop ensures that your account is protected by advanced encryption technology. Your personal information, payment details, and loan data are kept secure, giving you peace of mind when managing your commercial vehicle loan online.

8. Document Access and Storage

All important loan-related documents, such as the loan agreement, terms and conditions, and payment receipts, are available for download and storage within the login portal. You can easily access these documents whenever needed for your records or for future reference.

Also Read : Raja Luck Login | Vanghee Login | MTM Portal Login

How to Access Your Skop Login Account

Accessing your Skop Login account is a simple and quick process. If you’re a new user, you’ll first need to register for an account. After registering, you’ll receive login credentials that will allow you to sign in and manage your commercial vehicle loan.

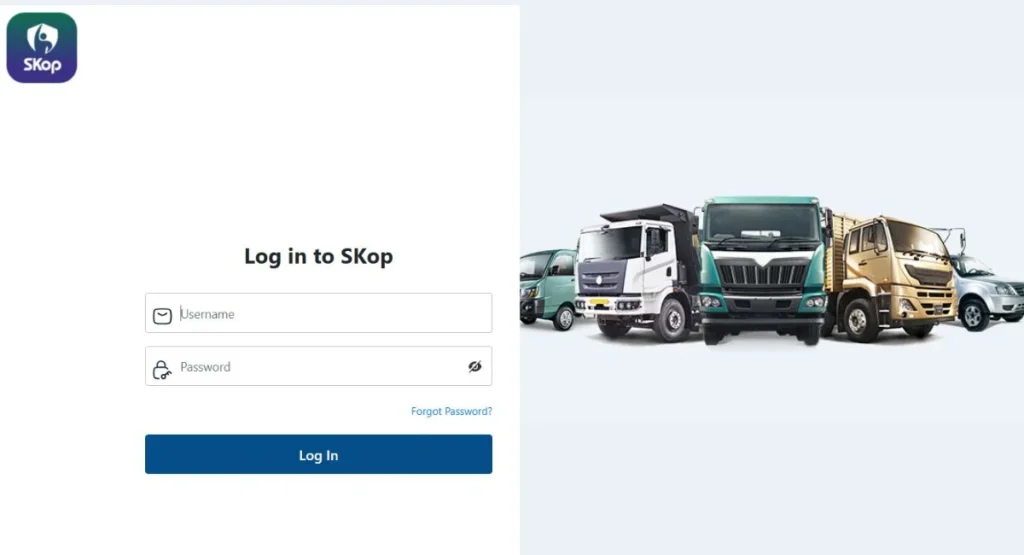

Here’s a step-by-step guide to help you log in to your Skop account:

Step 1: Visit the Skop Website

To begin, open a web browser and go to the official Skop website. You will find a clear and easy-to-navigate interface that directs you to the login page.

Step 2: Click on the Login Button

On the homepage of the website, look for the “Login” button, typically located in the top right corner of the screen. Click on this button to be directed to the login page.

Step 3: Enter Your Credentials

On the login page, you will need to enter your registered email address or username along with your password. Make sure that the information you enter is correct. If you forget your credentials, most platforms, including Skop, have a “Forgot Password” feature to help you recover or reset your login information.

Step 4: Secure Login

Once you’ve entered your login information, click on the “Login” button. Depending on the platform’s security settings, you might be asked to verify your identity through two-factor authentication (2FA) or a security question.

Step 5: Access Your Account

Once logged in successfully, you will have full access to your loan account. You can view your loan details, make payments, apply for a new loan, or download important documents as needed.

Benefits of Using Skop for Your Commercial Vehicle Loan

Skop Login provides several advantages that make it an excellent choice for managing commercial vehicle loans. Here are some key benefits:

1. Convenience

The Skop Login platform is accessible 24/7, which means you can manage your loan account at your convenience. You don’t have to wait for office hours to get access to your account or make a payment.

2. Real-Time Updates

Skop provides real-time updates on your loan status, payments, and any changes to your loan terms. This helps you stay informed and make timely decisions about your loan management.

3. Paperless Process

With Skop, all your loan documents are available digitally, eliminating the need for paper-based records. This reduces clutter and makes it easier to keep track of important information.

4. Customizable Payment Options

Skop offers flexible repayment options, allowing businesses to choose the payment schedule that works best for their cash flow. This flexibility ensures that your loan payments are manageable.

5. Financial Transparency

By providing detailed loan statements and breakdowns, Skop ensures that you have complete visibility into your loan’s terms and repayment status. This transparency helps you plan your finances better and avoid any surprises down the line.

Also Read : Jodie Woods Age | Salish Matter Age

Conclusion

Skop Login offers an intuitive and secure platform for managing your commercial vehicle loan. Whether you’re a small business owner or part of a larger fleet management company, Skop Login provides the tools and resources to help you stay on top of your loan payments, track your progress, and manage your finances effectively. With the convenience of online access, flexible repayment options, and real-time updates, Skop ensures that your commercial vehicle loan experience is smooth and stress-free.

Skop Login FAQs

What should I do if I forget my Skop password?

If you forget your Skop password, you can use the “Forgot Password” feature on the login page. This will guide you through the process of resetting your password using your registered email address.

Can I access my Skop Login account on mobile?

Yes, Skop offers a mobile-friendly platform, allowing you to access your loan account via your smartphone or tablet. You can manage your loan, make payments, and check your balance from anywhere.

How secure is my information on Skop?

Skop uses advanced encryption technologies to ensure that your personal information and loan details are protected. Additionally, two-factor authentication (2FA) may be required for added security when logging in.

Can I apply for a new commercial vehicle loan through Skop?

Yes, you can apply for a new commercial vehicle loan through the Skop platform. The application process is straightforward, and you can receive instant pre-approval by completing the required forms and submitting the necessary documents.

What payment methods does Skop accept?

Skop typically accepts a variety of payment methods, including credit/debit cards, bank transfers, and online payment services. Specific payment options may vary depending on your region or account settings.

6. How do I contact Skop customer support?

Skop offers customer support through its login portal. You can contact them via email or use the live chat feature for immediate assistance.

7. Can I download loan documents from my Skop account?

Yes, you can download all important loan-related documents, such as agreements, receipts, and payment statements, directly from your Skop account.